Does Home Insurance Cover Boiler Issues? Expert Guide

Our expert guide explains whether home insurance covers your boiler and the best ways to protect it.

Published:

When you purchase through links on our site, we may earn an affiliate commission. Here's how it works.

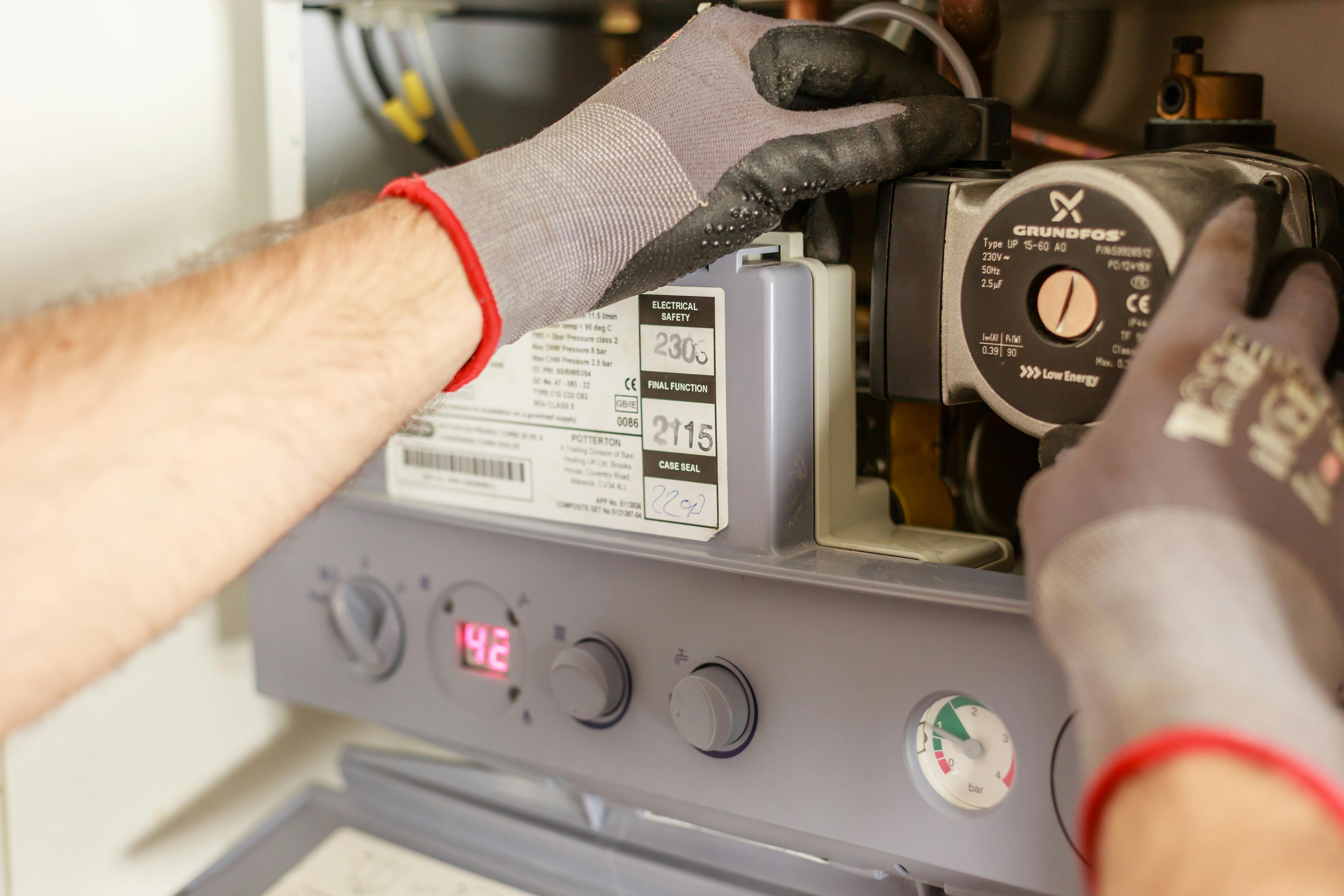

A boiler is a common appliance in most UK homes, and like other household equipment, it's not averse to breakdowns. However, a boiler failure poses a greater concern to homeowners because the repair or replacement costs can be hefty, not to mention the loss of access to hot water and heating.

With this in mind, you may be wondering: Does home insurance cover boiler failures or breakdowns? Here’s everything you need to know.

Key takeaways

- Standard home insurance can cover boiler repairs or replacement as a result of accidental damage from insured events such as fire, flood, storm, or vandalism but not for general wear and tear or lack of maintenance.

- Dedicated boiler cover or home emergency cover can provide more comprehensive protection against boiler breakdowns.

- Regular boiler maintenance, including an annual service, checking pressure, bleeding radiators, and addressing issues early, can extend your boiler's lifespan, improve efficiency, and reduce the chances of a breakdown.

Does home insurance cover your boiler?

The short answer is yes; your home insurance can cover the cost of repairing or replacing your boiler. However, this is only if the damage is accidental and not the result of neglect, misuse, or natural wear and tear.

When is boiler repair or replacement covered by home insurance?

Home insurance covers boiler repair or replacement if the damage is caused by an insured event. These are incidents that fall under the terms of your policy, such as:

- Fire or explosions.

- Floods or escape of water (such as a leak from your plumbing system).

- Storm or impact damage (such as falling trees or structural collapses).

- Theft or vandalism. (Keep in mind insurers may require proof of forced entry or police reports to process claims.)

When is boiler repair or replacement not covered by home insurance?

There are several situations where your home insurance won’t cover repairs or replacements.

- General wear and tear: If your boiler breaks down due to old age or regular use, you’ll need to pay for repairs or a replacement yourself.

- Lack of maintenance: Insurers expect homeowners to take reasonable care of their property, including boilers. If your boiler breaks down because it hasn’t been properly maintained (e.g., skipped annual servicing), your claim is likely to be denied.

How to determine what your home insurance covers

Here’s how to determine if your home insurance covers your boiler.

Review your policy documents

The first step is to read your policy documents carefully. Look for sections that mention the following:

- Boilers or central heating systems: Some policies explicitly state whether boilers are covered.

- Accidental damage: Check if this is included and whether it applies to boilers.

- Home emergency cover: See if this is included as part of your policy or available as an add-on.

Check for exclusions

Pay close attention to the exclusions section of your policy. Common boiler-related exclusions include:

- General wear and tear

- Mechanical or electrical failures

- Damage due to lack of maintenance

Understanding these exclusions can help you avoid unexpected costs and plan accordingly.

Ask your insurer directly

If your policy documents are unclear, reach out to your insurer. Ask specific questions like:

- Does my policy cover boiler repairs or replacements, and under what conditions?

- Are there any add-ons (e.g., home emergency cover) that I can purchase for boiler protection, and how much will these increase the cost of my home insurance?

- What circumstances or scenarios can lead to a denial of my claim?

Types of boiler cover

If your home insurance doesn’t provide adequate protection for your boiler, the good news is that there are specific types of boiler cover offering more comprehensive protection. Here are some options to consider:

Boiler and heating cover

Boiler and heating cover is a specialised insurance product designed to protect homeowners against the costs of repairing their heating systems and boilers. It’s typically available as either a standalone policy or an add-on to your home insurance. You can choose between the following levels of coverage:

- Boiler breakdown cover: This type of policy pays for repairing the boiler and its components if it experiences issues. There’s usually an emergency helpline to ensure you get the assistance you need promptly. A qualified engineer will come to your home, typically within 24 hours, to assess the damage and perform the necessary repairs. Your policy will cover the call-out fee, labour costs, parts, and, in some cases, the replacement of the boiler if it can't be repaired.

- Central heating cover: This extends beyond the boiler and covers your entire central heating system, including radiators, hot water tanks, and pipework.

Some boiler cover policies include an annual service to maintain the boiler’s efficiency and prevent future issues.

Home emergency cover

Home emergency cover is a broader insurance product that covers the following:

- Boiler and heating system repairs for faults or breakdowns.

- Plumbing and drainage issues, such as burst pipes or blockages to sinks, drains, and toilets.

- Electrical problems, such as faulty wiring or broken fuse boxes.

- Security emergencies, such as broken locks, jammed doors, or malfunctioning alarm systems.

- Pest infestation, such as a wasp nest in your attic or a rodent infestation.

- In some cases, temporary alternative accommodation is provided if an emergency incident makes your home unlivable.

Home emergency cover is ideal for homeowners who want comprehensive protection against various home emergencies, not just boiler breakdowns.

Some home insurance policies include home emergency cover as standard, but for most, it’s an optional add-on. You can also purchase it as a standalone policy, either from your home insurance provider or another insurer, though the latter option is likely to cost you more due to the higher administrative costs of managing a separate contract.

Like boiler cover, home emergency cover typically includes an emergency helpline you can contact anytime for assistance.

Preventing boiler breakdowns

Regular maintenance can extend your boiler’s lifespan, improve efficiency, and reduce the likelihood of costly failures. Here are some practical steps to keep your boiler running smoothly:

Schedule regular servicing

Have your boiler serviced by a qualified engineer at least once a year. Regular servicing helps identify potential issues early, preventing them from turning into major problems. It also ensures that your boiler runs efficiently, reducing energy bills.

If your boiler is still under warranty, annual servicing may be required to keep the warranty valid. Additionally, servicing your boiler might be an official requirement of your home insurance—if an unserviced boiler leads to an accident, it can invalidate your home insurance.

Check pressure

Monitor your boiler’s pressure gauge at least once a month to make sure it’s in the recommended range. Low or high pressure can cause inefficiencies or lead to breakdowns. If you’re unsure how to adjust the pressure, refer to the manufacturer’s manual or contact a professional.

Bleed your radiators

Over time, air can get trapped in your radiators, leading to inefficient heating. Bleed your radiators at least once a year. This action removes the trapped air and helps your boiler work more efficiently, reducing strain on the system. It’s a simple task that you can do yourself.

Keep the area around your boiler clear

Make sure there’s plenty of space around your boiler for proper ventilation. Avoid storing items near the boiler, as this can block airflow and cause overheating.

Address issues early

If you notice any warning signs, such as strange noises, leaks, or a loss of heating efficiency, don’t ignore them. Contact a qualified engineer to diagnose and fix the problem before it escalates.

Insulate your pipes

During colder months, frozen pipes cause an inadequate flow of water and can prevent your boiler from functioning properly. Insulating exposed pipes helps prevent freezing. However, if pipes do freeze, thaw them gently using warm (not boiling) water or a hot water bottle.

How to get the best coverage for your boiler

With the right approach, you can secure coverage that offers peace of mind without breaking the bank. Here are some useful tips.

Review your existing policy

Before purchasing additional boiler cover, check your home insurance policy to see if boiler-related issues are already covered. You might find that the coverage offered under your existing policy is sufficient. Only take out dedicated cover if you feel the protection provided by your home insurance is inadequate.

Note that including boiler cover as an add-on to your current policy is often cheaper than purchasing a separate policy.

Check if your warranty is still active

Many boilers come with a manufacturer’s warranty covering several years of repairs or replacements. If your boiler is still under warranty, check the terms to see what’s covered and what you need to do to keep it active. If repairs and replacements are included, you may not need to take out separate boiler insurance.

Read the fine print

If you decide to take out specialised boiler cover, read the terms and conditions carefully before you sign up. Pay attention to exclusions, claim limits (i.e., any caps on how much the insurer will pay for repairs or replacements), and waiting periods (some policies have a waiting period before you can make a claim).

Review your policy regularly

Periodically review your policy to ensure it still meets your needs. Be aware of any changes in coverage or exclusions and adjust your policy if necessary.

FAQs

How do I choose between adding boiler cover to my home insurance or getting separate cover?

It depends on the level of protection you want. If your home insurance provider offers good boiler cover add-ons with reasonable premiums, it may be the most convenient option. However, separate cover will be a better choice if you’re after specialised care for your boiler system.

What is the difference between boiler breakdown cover and home emergency cover?

Boiler breakdown cover is specifically designed to protect you against the costs of repairing or replacing a faulty boiler. Home emergency cover is a broader type of insurance that covers boiler and plumbing issues, central heating problems, and electrical faults, among many other home emergencies.

What is a boiler indemnity policy and do I need it?

A boiler indemnity insurance policy protects homeowners from future legal costs and damages if there are issues with a boiler installation or safety. You may need it if you’re selling a home and can’t trace the proper documentation, such as the installation certificate or proof of compliance with building regulations. Some mortgage lenders or solicitors might specifically request this policy before finalising the sale.